Facilitate Withdrawals Overview

Facilitate Withdrawals to help the merchant provide required Know Your Customer (KYC) information so they may receive their money and withdraw funds collected from payers.

- Embedded Withdrawal: Using an embedded iframe form, collect the required information from the merchant within your user experience

- Custom KYC and Withdrawal: This feature has been deprecated, and any documentation is for reference by grandfathered-platforms only.

- Settlement: Learn about Same Day Deposits, WePay’s reserve policy, and how the flow of funds works.

Ready to get started?

Sign up to use WePay. Get your keys and start making API calls.

Custom KYC Legal Requirements

For platforms who have already implemented custom KYC, use these requirements to guide your implementation:

Merchant Information

Federal regulations require collection and verification of specific identity information from merchants. These regulations are designed to prevent the misuse of financial systems and prevent financial crimes such as money laundering and terrorist financing. This document describes the information merchants are required to provide in order to use financial systems. All merchants must meet these requirements before they can complete payment processing and settle funds with WePay.

The following information must be collected from each merchant:

1. Merchant’s Entity Type

The charts below show different entity types and descriptions. Each merchant must select one entity type.

| Entity Type | Description |

|---|---|

| Sole Proprietor |

|

| Corporation |

|

| LLC |

|

| Partnership |

|

| Nonprofit Corporation |

|

| Unincorporated Association |

|

| Personal Trust/Estate |

|

| Statutory Trust |

|

| Government Agency |

|

2. Merchant’s Legal Name

The business’s legal name is required. For sole proprietors, you can pre-fill this with applicable information already submitted to you. Any pre-filled information here for sole proprietors should be presented in an editable field called doing business as (DBA).

3. Government Identification Number

| Entity Type | Required Identification Number |

|---|---|

| Individual |

|

| Sole Proprietor |

|

|

|

| Government Agency | N/A |

1 WePay generally requests the last four digits of SSN (SSN4) to verify an individual’s SSN, but will require full SSN (SSN9) if unable to verify a merchant with the provided SSN4.

4. Merchant’s Full Address

5. Description of Merchant

6. Merchant website (if available)

7. Merchant phone number

8. Controller Information (For Merchants that are Legal Entities)

A merchant that is a legal entity (i.e., not a sole proprietor) has a controller. A controller is a single individual with significant responsibility to control, manage, or direct a legal entity customer such as an executive officer, senior manager or other individual who regularly performs similar control functions.

The following information must be collected from a controller:

- Full Name

- Job title: Some examples of different titles for a controller are: Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Managing Member, General Partner, President, Vice President, or Treasurer.

- Full Residential Address

- Phone number

- Date of birth (month, day, year)

- SSN (US only)

9. Beneficial Owner Information (For Merchants that are Legal Entities but not Nonprofits)

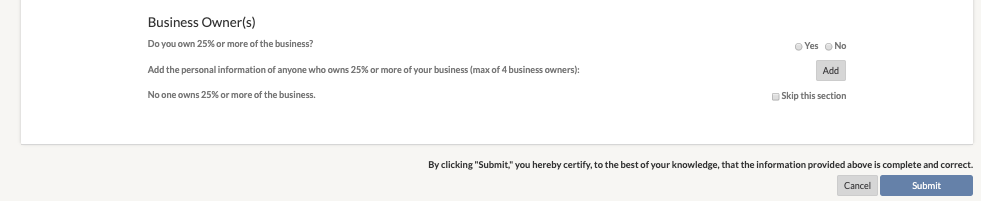

For merchants that are legal entities, a beneficial owner is someone who owns 25% or more of the merchant’s equity. Since nonprofit organizations do not have owners or equity, there are no beneficial owners for nonprofits.

The following information must be collected from a beneficial owner:

- Full Name

- Full Residential Address

- Phone number

- Date of birth (month, day, year)

- SSN (US only)

Attestation Language

In addition to simply collecting the elements described above, federal regulations require that the person submitting verification details certify to the completeness and accuracy of the information provided. Traditionally, this requirement is fulfilled by including a specific attestation language and obtaining signature on the same form used to collect identity information. Note: This attestation should be included not only when the identity information is submitted for the first time, but also when identity information is updated.

In a digital setting, this requirement can be fulfilled by including attestation language in the same user experience used to collect identity information and obtaining the electronic equivalent of a signature - timestamp, IP address, username or any other ID. Sample attestation language is provided here:

By clicking “Submit,” you hereby certify, to the best of your knowledge, that the information provided above is complete and correct.

As an example, WePay provides this language in the embedded and hosted KYC flow:

Certification Checklist

In summary, you must provide, and will only be certified after you provide:

- UIs providing the complete list of entity types for your merchants to select from

- UIs for collecting the correct identification numbers (e.g., EIN or Business Number) from each merchant based on entity type and country

- UIs for all required merchant information fields

- UIs for all required controller information fields for all entity types except individuals and sole proprietors

- UIs for all required beneficial owner fields for all entity types except individuals, sole proprietors, and nonprofits

- UIs to collect attestation from the merchant

Last Updated: 7/31/2019